ORIENTAL ASSURANCE CORPORATION MEDICAL PLAN

Get yourself the best medical treatment possible!

PROTECT YOURSELF FROM THE RISKS OF LIFE!

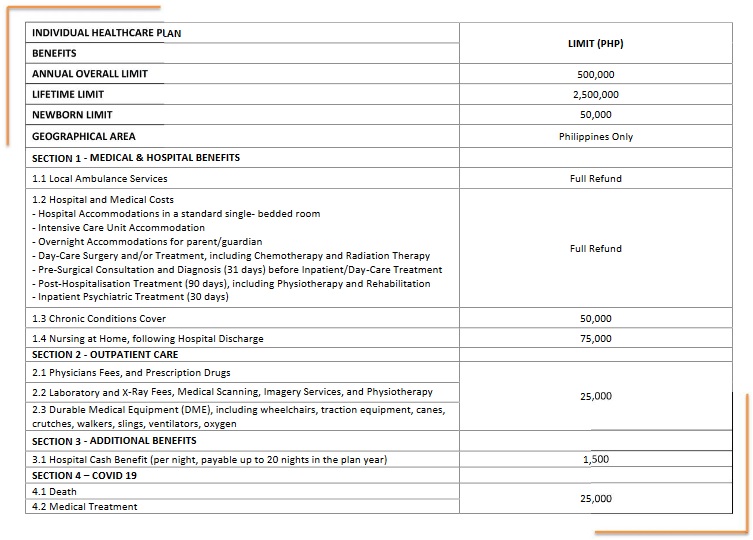

A unique product designed to provide financial assistance for serious illness, surgery, and accidental injury. OAC medical plan provides you with financial strength to cope with complications brought on by serious injury or illness.

Consider the situation you would be in if you are to contract a serious disease or incur an accidental injury. Could you afford the best medical treatment? Would your savings and investments be sufficient to meet the costs incurred? Would your current medical insurance be able to respond with immediate benefit payments? These are difficult questions. OAC’s medical plan, however, has all the answers. Through a unique combination of personal accident and medical benefits, we can give you the protection and security you deserve.

With OAC’s medical plan, you are protected against the risk of heart attack, stroke, most forms of cancer, kidney failure, coronary artery bypass surgery, major organ transplants, and other complex surgical procedures.

DHI – OAC Medical Plan will pay you a daily benefit for every day you are hospitalized up to 90 days per confinement.

THE PERSONAL ACCIDENT COVERAGE – A HASSLE FREE WAY OF COLLECTING WHAT YOU DESERVE!

In the event of death or permanent total disability resulting from accidental causes, OAC medical plan pays the full sum insured. For injuries suffered as a result of accidental causes, the medical plan will also reimburse up to 10% of the sum assured to cover the cost of necessary medical treatment.

FREQUENTLY ASKED QUESTIONS (FAQs)

Q: Do I need a medical examination for application?

A: No. However, we will ask that you fill out a health questionnaire satisfactory to us with regards to your medical history and general current state of health. If it is later discovered that the condition for which a claim is made existed at the time of the application, no claim will be paid.

Q: Will the benefits be paid in addition to any other insurance I may have?

A: Yes. The benefits are payable regardless of any other policy you may have.

Q: How is this medical plan different from other critical illness plans in the market?

A: First, most critical illness or dreaded disease policies ride on ordinary life insurance policies. This means that payment erodes the coverage under the protection. Second, the medical plan covers a broader range of illnesses and diseases while also covering complex surgical procedures and providing daily hospital cash benefits. Last, in addition to the benefits, the medical plan also covers accidental death, permanent total disability, as well as reimbursement for accidental medical expenses.

Interested? Let us assist you further by filling out the attached form to get a free quote.